5 Application of Williams Fractal indicators. Fractals show breakpoints. Using Fractals as the linking point of trend lines. Using Fractals to confirm a trend. 6 Trading using Fractals. 7 Applying Fractals to trading. 8 In conclusion. Traders are integrating new methods into Estimated Reading Time: 6 mins 4/20/ · How to use Williams Fractal Strategy? - Forex Day Trading - blogger.com: TRADING RUSH 6/8/ · bill william's fractal | Forex Factory. Platform Tech. /. Reply to Thread. Subscribe. 2. Attachments: bill william's fractal. Exit Attachments

Bill Williams Alligator and fractals forex strategy : Rules and application [Video]

Fractals are indispensable assistants for Forex traders. That was the first time the author described fractals used in trading by the example of stock market analysis, williams fractal forex. Fractal used in Forex trading is a local high or low, williams fractal forex, which is marked by an up or down arrow on the price chart.

A fractal is a formation created by five candlesticks or bars, where the third candlestick always has the highest high or the lowest low as compared to the other ones:. The primary advantage of fractals over other technical analysis tools is that they display not only local highs and lows on the chart, but also enable to identify important support and resistance levels for any financial instrument.

According to the drawing principle, williams fractal forex, fractal will always lag by 2 or more candlesticks, and there's nothing we can do about it. Redrawing and lagging of indicators is a dangerous phenomenon, because an indicator can achieve very good backtesting results, but in fact, when a signal occurs, the price is much different from the signal one.

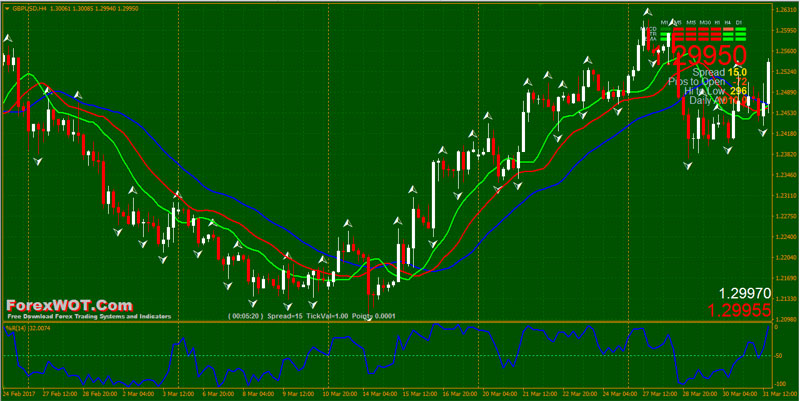

Each arrow on the chart marks a fractal. Since the given indicator is automatically set to draw fractals based on 5 candlesticks, fractals appear on the chart quite often. However, williams fractal forex, you can search for and download the indicator providing access to its settings, if you wish. That is, williams fractal forex can tell your terminal how many candlesticks must be included in one fractal. Bill Williams williams fractal forex to use fractals in the strategies based on breakout of the important price levels.

According to the author of this indicator, the price williams fractal forex for at least one point above or below the level of the previous fractal indicates breakout of this level by the price.

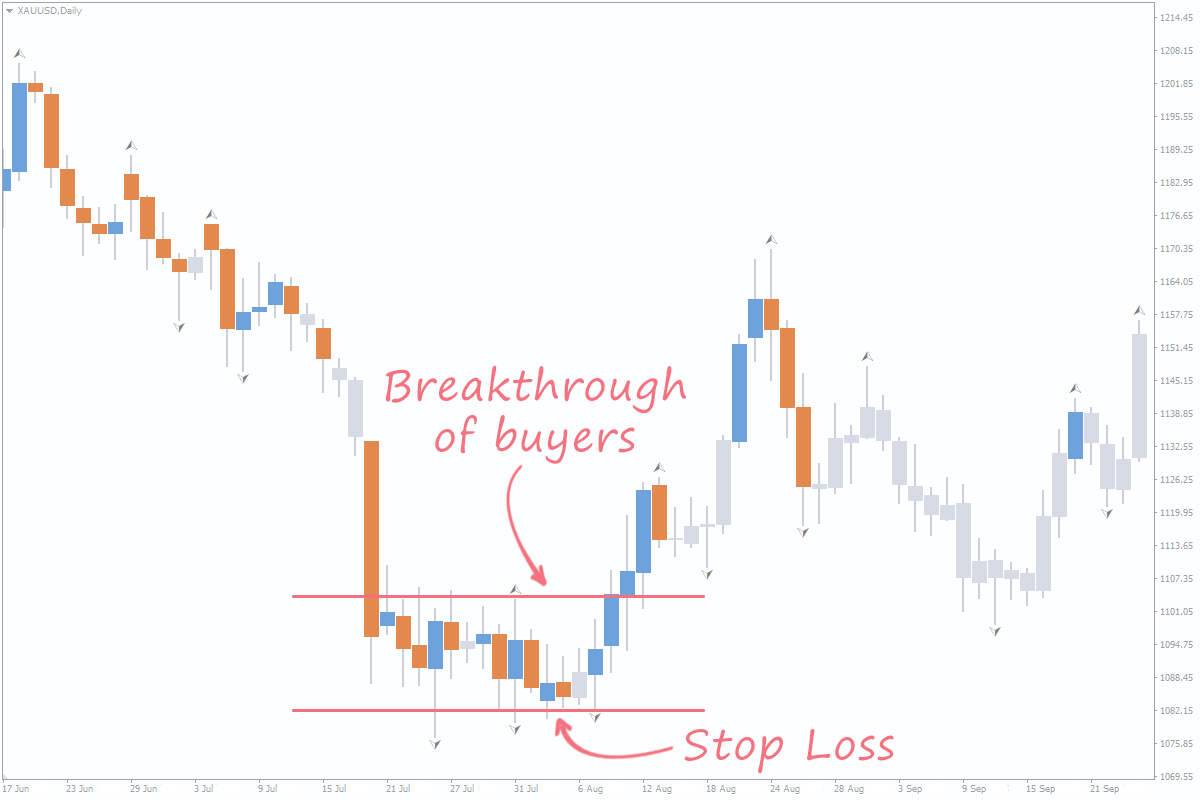

Breakout of the previous fractal level is called a breakthrough williams fractal forex buyers if the price rises above the previous upward fractal. Otherwise, when the price falls below the previous downward fractal level, they call it a breakthrough of sellers, williams fractal forex. Bill Williams advised to consider a breakthrough of buyers or sellers as a signal to open a position.

As we have mentioned breakouts here is some useful info on Most Common Breakout Strategies in Forex. Normally, traders place pending Stop orders a few points above or below the fractal level to open a position in case of this level breakout.

In such cases, Stop Loss is set at the level of the second-to-last opposite fractal. This situation is shown in the picture below:. The author of the strategy recommended to enter the market right after breaking the fractal up or with a pending Buy Stop order. Market entry with a pending Sell Stop order is made in case of breaking the fractal located williams fractal forex the red line. You can use another great property of fractals — drawing the Fibonacci grid with them — in the foreign exchange market.

As you know, the Fibonacci grid is stretched between a local low and high: this is precisely why traders can use fractals for. Therefore, the area between two fractals can be considered the price movement, williams fractal forex, which the technique of retracements and Fibonacci extensions can be applied to.

According to the author, fractals are among the few tools of technical analysis that really work. March 31, Description of Bill Williams Fractals Indicator in Forex Fractal used in Forex trading is a local high or low, which is marked by an up or down arrow on the price chart.

Forex Basics. Related Articles. Vital Checks Before Entering the Market and Why a Trading Plan Is So Important. The Difference Between Trading Forex and Currency Futures. What Are the Major Currency Pairs in Forex? Sign In. With E-mail. What's Next? Learn basic Sentiment Strategy Setups.

Alligator and Fractals Trading Strategy

, time: 17:37How to Trade Bill Williams Fractals- A Fractal Trading Strategy

3/15/ · 9 Step #2: Trading Fractals Bill Williams: Identify where the Fractal Has Formed (above or below alligator teeth) 10 Step #3: The price action must stay above the Alligator Teeth for at least 5 consecutive candles (Buy Trade) 11 Step #4: Price Action Need to Break Above Fractal Candle That was Distinguished in Step #blogger.comted Reading Time: 9 mins Fractals are simple 5-bar inversion models - they were invented by Bill Williams. Bill Williams was a well-known trader, author, and instructor with over 50 years of trading experience across multiple markets. He was known for his views on the psychology of trading, chaos theory and its application to technical analysis 5/27/ · Bill Williams Alligator and fractals forex strategy: Rules and application [Video] Alligator was developed by the famous trader Bill Williams. Bill Williams was also one of the pioneers of market

No comments:

Post a Comment