A trailing stop is a modification of a typical stop order that can be set at a defined percentage or dollar amount away from a security's current market price. For a long position, an investor Oct 27, · Quite simply, a trailing stop is a stop loss order that follows the market in a profitable direction ONLY. Therefore, locks in profit as your trade continues to profit in real blogger.comted Reading Time: 5 mins Mar 12, · A trailing stop is a way to automatically protect yourself from the downside while locking in the upside. A trailing stop order resembles a stop loss order in that it automatically closes the trade if the market moves in an unfavorable direction by a specified blogger.comted Reading Time: 2 mins

Trading Forex With a Trailing Stop

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can learn more about our cookie policy herewhat is a trailing stopin the forex market, or by following the link at the bottom of any page on our site. See our updated Privacy Policy here. Note: Low and High figures are for the what is a trailing stopin the forex market day. One of the recurring issues I see with new traders is their difficulty with exiting open positions.

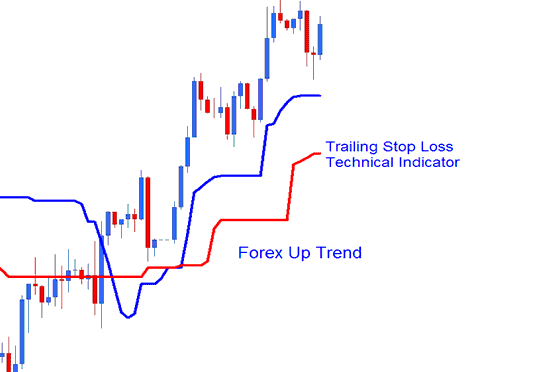

This is unfortunate as knowing when to exit a trade is vital for any trading plan, and is often what separates new traders from professionals in the Forex trading world. With this in mind, today we will examine how to effectively manage an open position using a trailing stop. First, it is important to know that a fixed trailing stop is an advanced entry order designed to move a stop forward a specificed amount of pips after a position has moved in your favor.

Traditionaly fixed trailing stops are used in conjuncture with a trending market strategy, to lock in profits on an extended move. Today we will take a look at a sample trade on the EURJPY 8HR chart pictured below, to examine how a trailing stop may work in our favor. The chart below depicts our initial entry to sell the EURJPY at To initially contain our risk there is a stop of pips being placed at The Chart above also depicts what will occur if the EURJPY moves in our favor as planned, what is a trailing stopin the forex market.

Since our trail is set to this means that if our trade moves pips in our favor our stop will update that same amount. In this example this means our first trail would update our stop to From here the trailing stop will continue to lock in profit every time the trade moves in our favor the selected amount.

It is important to remember that the trailing stop by design is designated to close our trade. At any point in time a trade may move against our position and close the position at the designated stopping point.

If this occurs immediately in the example above our position would be closed for a pip loss. However, when using the benefits of a trailing stop we can then continue to lock in profit as the trend moves in our favor. Always using a stop-loss is a good habit for traders to get into. Stop-losses are an important part of any trading strategy and an essential component in risk-management.

Furthemore, using a stop-loss and take-profit to ensure a positive risk-reward ratio on a trade has been shown to possibly increase a traders success. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, what is a trailing stopin the forex market, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content.

For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions, what is a trailing stopin the forex market. Live Webinar Live Webinar Events 0.

Economic Calendar Economic Calendar Events 0. Duration: min. P: R:. Search Clear Search results. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook What is a trailing stopin the forex market News Headlines. Rates Live Chart Asset classes.

Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

Economic Calendar Central Bank Calendar Economic Calendar. Consumer Confidence JUN. P: R: Housing Starts YoY MAY. P: R: 7. GDP Growth Rate YoY Final Q1. F: Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides.

Company Authors Contact. of clients are net long. of clients are net short. Long Short. News US Yields Going Which Way? Stocks Keep Climbing; Bitcoin Line in the Sand - The Macro Setup Oil - US Crude. Crude Oil Price Forecast: A Slow and Steady Grind Higher, but Red Flag Appears Wall Street. News Dow Jones Steady as Tech Stocks Rally, Hang Seng May Rebound US Yields Going Which Way?

More View more. LEARN FOREX: How to Effectively Use a Trailing Stop Walker England, Trading Instructor. Recommended by Walker England, Trading Instructor. New to Forex trading?

Get My Guide. Related Articles How to Read a Forex Economic Calendar Everything You Need to Know About Types of Stocks Safe Haven Stocks to Trade in Volatile Markets Becoming a Better Trader — Principles of Risk Management Video html'; this.

createElement 'script' ; s. js'; s. setAttribute 'data-timestamp', new Date ; d. head d. appendChild s ; }. Market News Market Overview Real-Time News Forecasts Market Outlook. Market Data Rates Live Chart. Calendars Economic Calendar Central Bank Rates.

Education Trading courses Free Trading Guides Live Webinars Trading Research Education Archive. DailyFX About Us Authors Contact Archive. First Name: Please fill out this field. Please enter valid First Name. Last Name: Please fill out this field. Please enter valid What is a trailing stopin the forex market Name. E-Mail: Please fill out this field. Please enter valid email.

Forex Trading Tips - Trailing Stops

, time: 15:40LEARN FOREX: How to Effectively Use a Trailing Stop

Trailing stops are stop loss orders, which follow the course of trade and move in favor of a traders either long or short position. It is more flexible than the fixed stop loss, because it follows a currency pairs value direction and does not need to be manually reset like the fixed stop loss. Best Forex Brokers for United States Nov 07, · First, it is important to know that a fixed trailing stop is an advanced entry order designed to move a stop forward a specificed amount of pips after a Estimated Reading Time: 2 mins Mar 08, · The forex market is typically a little "whippy," which means that currency pairs can cycle up and down before moving their ultimate direction. If you set a tight stop close to your price and the price whips forward and back, your trailing stop is likely to be hit. So, it's something that you should use blogger.comted Reading Time: 4 mins

No comments:

Post a Comment