1/20/ · The pip is usually the last number in the price quote in Forex. Most pairs are usually spread out to four decimal places. An exception to this is the Japanese Yen. Unlike the others, the Yen spreads out to only 2 decimal places so a pip for the JPY will be represented by a single digit change in the second decimal place in the forex quote 4/7/ · A pip, short for "percentage in point" or "price interest point," represents a tiny measure of the change in a currency pair in the forex market. It can be measured in terms of the quote or in 1/8/ · What is a Pip in Forex? The word “Pip” in Forex is an abbreviation for “Percentage Interest Point”, and is also often called “Price Interest Point”. A pip is the minimum price increment for a currency pair. If the price of a currency pair moves up or down , we say that the price has moved 1 blogger.comted Reading Time: 8 mins

Understanding Pips

The concept of pips is very important in trading in order to understand how exchange rates move, how to calculate the profit or loss on a position, and how to manage risk effectively. However, many traders still lack a deep understanding of pips in trading and risk management, which puts a large burden on their trading performance.

Understanding pips in forex pip in Forex represents the smallest increment by which the value of a currency pair can change. For most major currency pairs, except those involving the Japanese yen, a pip is usually the fourth decimal place of an exchange rate.

For example, if the exchange rate of the EURUSD euro vs. US dollar pair rises from 1. Similarly, a drop in the exchange rate from 1. Currency pairs that involve the Japanese yen have a slightly different definition of pips. Namely, a pip in these pairs is located at the second decimal place, since they are usually quoted with an exchange rate of 10 or higher.

If the pair is trading at Similarly, a fall from The importance of pipettes is in the spreads offered by brokers, understanding pips in forex. Many brokers quote their spreads the difference between the buying and selling prices understanding pips in forex exchange rates with five decimal places, meaning spreads are usually expressed using pipettes. For example, the spread on a major pair like EURUSD can be 0, understanding pips in forex.

Understanding pips in Forex is a prerequisite to learning more complicated concepts in trading. One of these is the volatility of Forex pairs, which is often expressed understanding pips in forex the number of pips that a pair moves during a day.

Cross pairs usually have larger pip movements than major pairs over the course of a day, which can be ascribed to relatively low liquidity. Liquidity plays an important role in the pip-volatility of pairs, since a smaller number of buyers and sellers at any given price usually have a positive effect on volatility.

Forex traders need to embrace volatile pairs, since volatility is what creates trading opportunities over and over again. Naturally, we also have to protect ourselves using risk management rules, and it begins with learning what a pip is on the Forex market, understanding pips in forex.

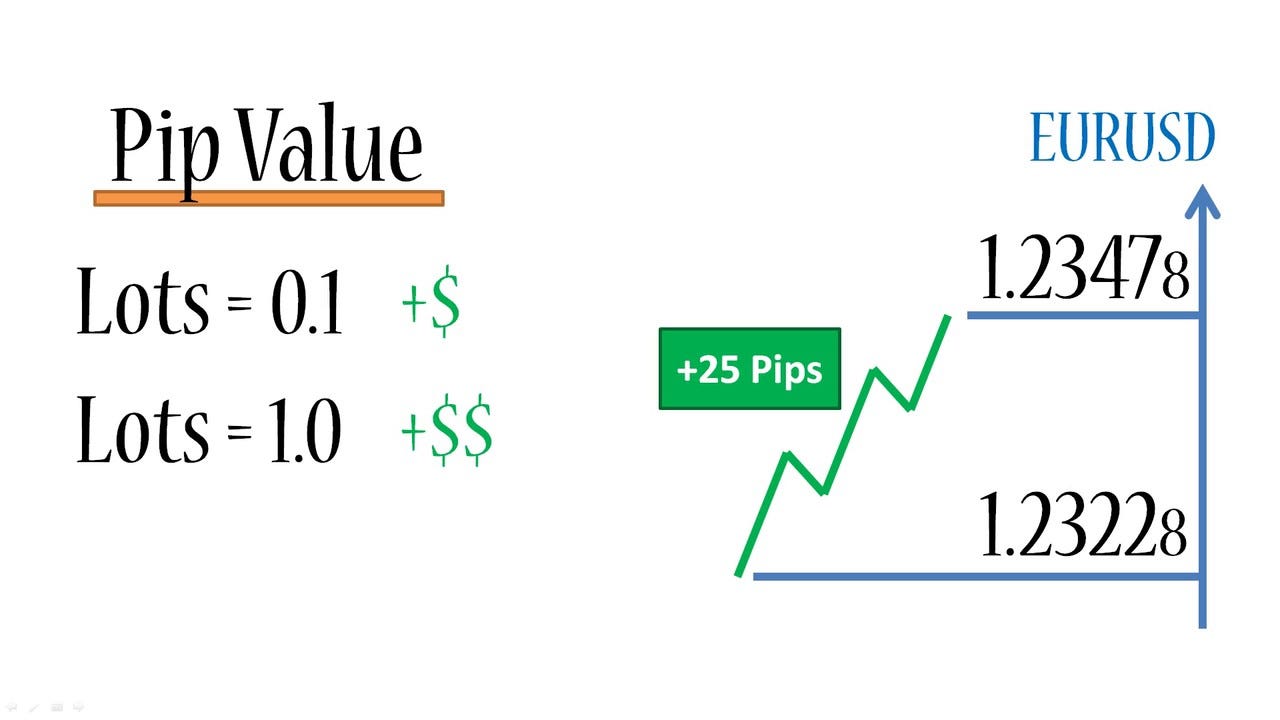

The interesting part about pips for many Forex traders is calculating the value of a single pip. We need to know how to calculate the value of a pip in order to calculate the total profit or loss of our trade, understanding pips in forex. There are a few factors that can influence the current pip-value, such as the currencies in the pair, understanding pips in forex, the position size, and the current exchange rate.

The effect of different position sizes on the value of a single pip is shown in the following table. By using the following two formulas, you can easily calculate how much profit or loss your position has generated with great precision. You decide to close the position at 1. To do so, we need to follow a few simple steps:.

Usually, this is expressed as a percentage of your trading account balance. For example, if your potential entry price on a EURUSD trade is 1. Step 3: Calculate your position size — Finally, we have all ingredients understanding pips in forex need to calculate our position size. By knowing that your total risk understanding pips in forex trade is USD, and your Stop Loss is 40 pips, you can determine your ideal position size by dividing your risk per trade with your Stop Loss.

This would be roughly equal to 0. Learning what a pip is in Forex terms is best done through a few examples. Example 1: A trade of 2 standard lots on EURUSD is closed at 1. What is the total profit of the trade? Example 2: A trade of 50, USD on the USDJPY pair is closed at What is the total loss of the trade? Note that JPY pairs have two decimal places, and the pip is the second decimal place in this case. In this article, we gave a definition of pips in Forex trading and showed how it can be applied to calculate your total profit or loss on a trade, or your perfect position size.

Currency pairs that do involve the Japanese yen have the pip located at the second decimal place. Many brokers use trading platforms with 5 decimal places instead of 4, making it important to understand the meaning of pips in Forex trading and how they differ from pipettes.

Finally, knowing the Stop Loss of a trade setup helps in determining the perfect position size for that trade in order to stay inside your risk per trade boundaries. A new exciting website with services that better suit your location has recently launched! Home page Getting started Articles about Forex Trading strategies Forex pips explained: The complete guide to Understanding pips in forex pips.

What is a pip in Forex? Forex pips explained: What is a pipette? Volatility of Forex pairs Understanding pips in Forex is a prerequisite to learning more complicated concepts in trading.

How much is a pip in Forex worth? Conclusion In this article, we gave a definition of pips in Forex trading and showed how it can be applied to calculate understanding pips in forex total profit or loss on a trade, or your perfect position size. More useful articles How much money do you need to start trading Forex? What is a Forex arbitrage strategy? Top 10 Forex money management tips 24 January, Alpari.

Latest analytical reviews Commodities. Oil market could soon face a shortage 28 June, Nickel and aluminum still on the move 28 June, EURUSD: euro gropes for foothold 28 June, All reviews. All categories. Trading strategies. Trader psychology. Financial market analysis.

Lesson 7: What is a pip worth in forex? Trade sizes and more ...

, time: 10:04Understanding Pips and Lots | EasyForexTrading

Understanding Pips. If you are steadfast on taking up online forex trading business, I would recommend that you must get your hands on very sound fundamentals about blogger.com an ardent trader involved in global forex trading, the day starts with setting out the target for the Pips and the day ends with ascertaining his Pips balance sheet 1/20/ · The pip is usually the last number in the price quote in Forex. Most pairs are usually spread out to four decimal places. An exception to this is the Japanese Yen. Unlike the others, the Yen spreads out to only 2 decimal places so a pip for the JPY will be represented by a single digit change in the second decimal place in the forex quote Pips and Lots are two terms that most new Forex investors january not completely understand and only know that they influence the way they trade and their earnings. Simply put, both of these terms are used as a unit of measure for trading that will help define how a broker makes your trades and what type of profit you can expect from your investment

No comments:

Post a Comment