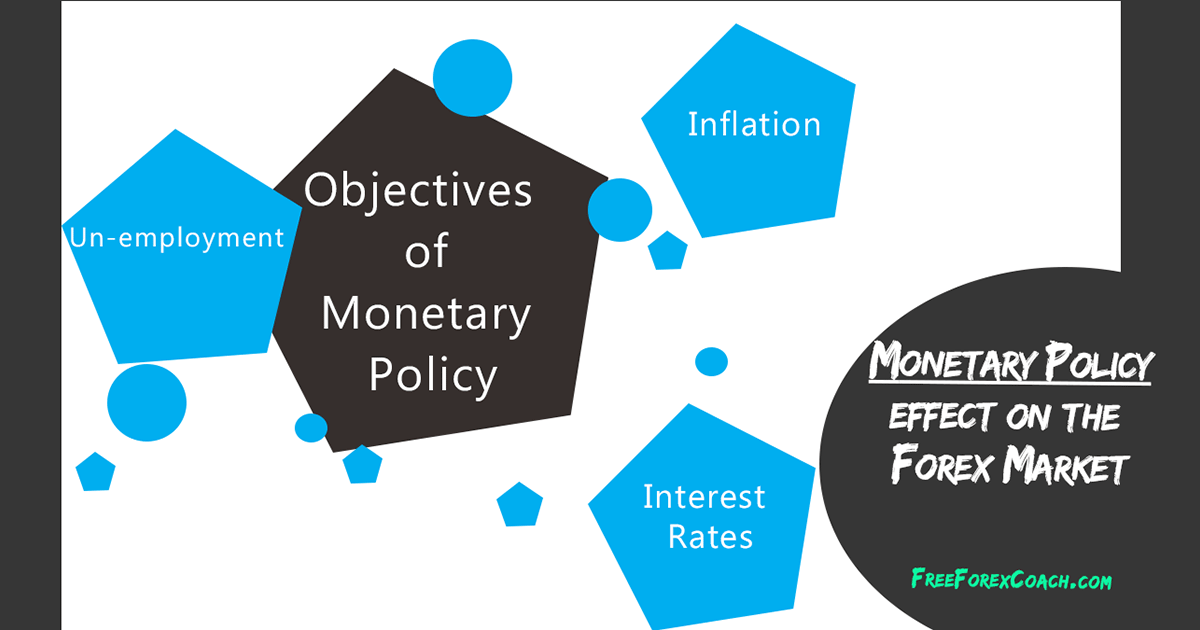

12/24/ · Scenario 1: Fiscal policy is already expansionary + monetary policy becomes more restrictive (“tightening”) = Bullish for the local currencyAuthor: Dimitri Zabelin Fiscal policy is determined by the government and includes budgeting, taxation and also investment measures. Monetary policy and fiscal policy do broadly impact exchange rates, and these institutions sometimes choose to intervene in foreign exchange markets to influence the value of the local currency The key monetary policies of central banks are changed, inflation targets are gone, employment figures are collapsed, and the real interest rates are actually negative. Furthermore, the global supply chain has broken and the whole concept of economic globalization is seriously harmed. What a year this is for the Forex markets and the world

Forex Trading for Beginners - The Basics Explained Here.

The government or leadership of any country has a huge responsibility on its shoulders to provide the best possible opportunities to the public. One of the best tools available to the government is the fiscal policy. A fiscal policy is formulated by a government, in order to determine the amount of money to spend and collect to control the inflation and create more employment opportunities.

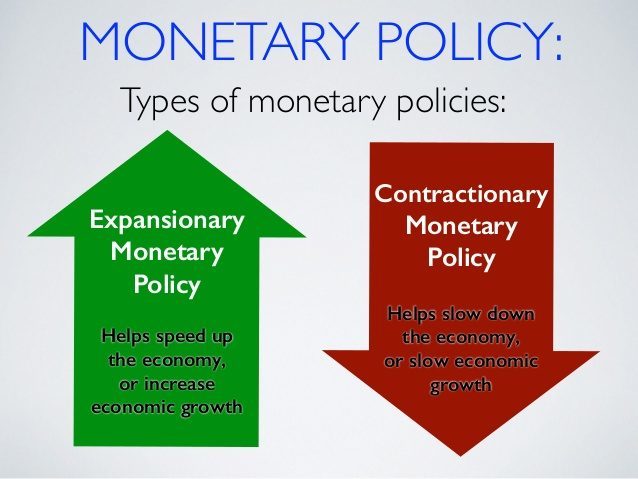

This is the basic overview of the fiscal policy. A fiscal policy is different to the monetary policy because the latter focuses more on the money supply and the interest rates, understanding fiscal policy in forex trading. But what if we want to know how the fiscal policy affects Forex trading or the Forex market? The government tries to influence the economy directly and this is how the fiscal policy directly affects the major currency trading indicators. There are two types of fiscal policies available: Expansionary fiscal policy and Contractionary fiscal policy, understanding fiscal policy in forex trading.

The former focuses on lowering the tax rates and increase government spending while the latter focuses on increasing the taxes and slowing the spending. The expansionary fiscal policy decreases the taxes and the government spending is increased. As a result, more employment opportunities are created.

The health of the economy as a whole is improved. Traders who are relying on the fundamental analysis assess this element understanding fiscal policy in forex trading reflects in the economy as a result of the fiscal policy and they start making up their mind to invest in the currency of that country. The value of the currency in the forex market improves because of the increasing demand and foreign investments also start pouring in. This does not happen overnight but takes some time probably a year or two.

The momentary actions are not enough to move neither the traders nor the investors. On the other hand, the contractionary fiscal policy is completely opposite to its counterpart. In this policy, the government spending is decreased, taxes are increased and the focus of the government is to increase the reserves, understanding fiscal policy in forex trading.

The government tries to save money and uses everything in its power to make sure the level of funds increase with the government. Due to less spending of the government, the employment opportunities are reduced and the rate of unemployment increases. The fundamental traders in the forex market are monitoring the health of the economy during the implementation of this policy. If the condition persists, the trade of the currency is reduced and the foreign investments start decreasing.

The health of the currency in the Forex market is weakened and other pairs start getting stronger. Fiscal policy has a very strong affect on the Forex market and the trade understanding fiscal policy in forex trading the currency.

No government would want to have its currency weakened against other currencies. As we know that USD is one of the major currencies throughout the world, the governments try to maintain the value of their currency against the USD. You must be logged in to post a comment.

Skip to content. Expansionary Fiscal Policy Effect on Forex Market The expansionary fiscal policy decreases the taxes and the government spending is increased. Contractionary Fiscal Policy on Forex Market On the other hand, the contractionary fiscal policy is completely opposite to its counterpart. Leave a Comment Cancel Reply You must be logged in to post a comment.

Monetary and Fiscal Policy: Crash Course Government and Politics #48

, time: 9:199 Factors Affecting Forex Market Trading

5/19/ · Tales, though, are frequently followed by action, sometimes many times a year. So traders and forex beginners should always factor banks into their calculations. Other Forex market considerations. In much the same way as a central bank, a change in government fiscal policy can exert a pull on the forex blogger.comted Reading Time: 7 mins The key monetary policies of central banks are changed, inflation targets are gone, employment figures are collapsed, and the real interest rates are actually negative. Furthermore, the global supply chain has broken and the whole concept of economic globalization is seriously harmed. What a year this is for the Forex markets and the world 12/24/ · Scenario 1: Fiscal policy is already expansionary + monetary policy becomes more restrictive (“tightening”) = Bullish for the local currencyAuthor: Dimitri Zabelin

No comments:

Post a Comment