1/28/ · In the next tutorial of the moving averages, we’ll discuss trading strategies using moving averages as well as combining two different averages and using their crossover as a signal. What Is a Moving Average in Forex Conclusion. To answer what is a moving average in Forex, you need to understand what they are and how they work 6/16/ · In Forex trading, a simple trading strategy can be created by using just some moving averages or MA’s along with some associated indicators. Moving Averages are generally used to identify support and resistance levels, as well as being used as a trend indicator 11/3/ · Moving averages are a frequently used technical indicator in forex trading, especially over 10, 50, , and day periods. The below strategies aren't limited to a particular timeframe and could

Moving Average Strategies for Forex Trading

Trends are your best friends. We have said that multiple times and we will continue underscoring it, because it is simply true. The article you are about to read explains another trend-following trading strategy, which uses a period Exponential Moving Average as the key support and resistance level to base your entry points on, in conjunction with slower EMAs for trend identification and the Average True Range for stop placement and adjustment.

We have spoken a lot about trends, trend lines, trend trading etc, trading using moving average forex, so we will not waste much time here. The strategy we are trading using moving average forex discuss is based on the broadly accepted idea that moving averages act as extremely strong support and resistance levels and because they are closely monitored and acted upon by institutional traders, not only individual ones, pullbacks to the MAs are reliable with-trend entry points.

It works best on a higher time frame hourly charts or larger. In our case, we will use a period Exponential Moving Average in conjunction with an hourly time frame. Keep in mind that institutional investors are most active on the higher time frames, daily etc, so best results will most likely be achieved there.

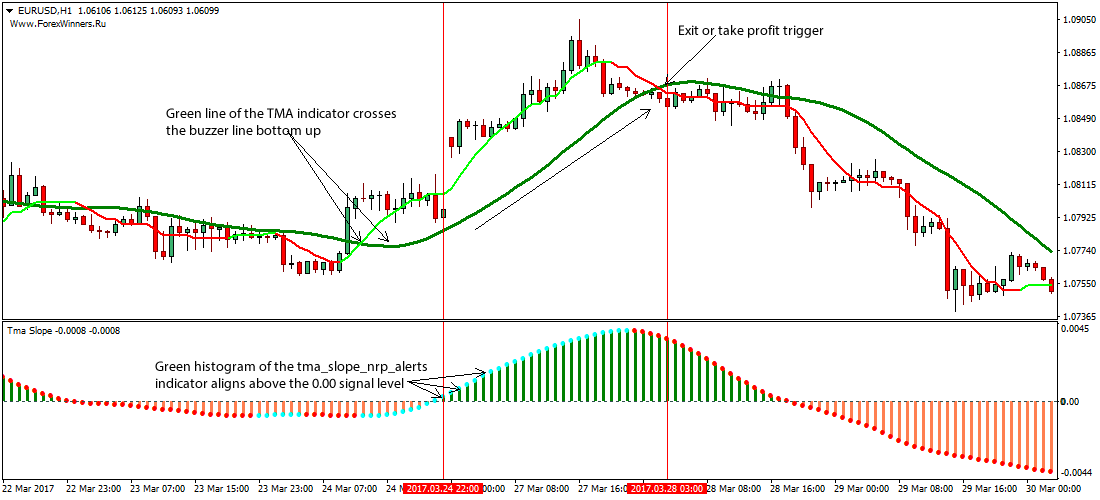

As you know, as trend-following indicators, moving averages require a trending market in order to be effective. Apart from using indicators such as the Average Directional Movement Index ADX and other similar tools, we can count on the position of different moving averages to one another as a technique to determine trend direction.

Not only that, but the EMAs are in the right order indicating a strong downward movement. As you can see, the period EMA yellow was the one closest to the price, acting as a resistance zone, except for trading using moving average forex short pullback period between June 24th and June 25th.

The period EMA blue was above it, and the period and period EMAs green and red respectively were also properly aligned above the faster EMAs, confirming the strong bear trend.

However, the trading strategy we are about to use works only with the strongest of trends, thus, the proper trading using moving average forex of multiple EMAs is not enough as single condition that needs to be met.

In the example above you can see how the market, which shortly before was in a trading range not displayedaccelerated into a bull trend and the period EMA acted as a strong support zone for the next almost 50 bars.

This is exactly the type of trend we are looking for. If the price keeps bouncing from the EMA and continues to advance, it shows that institutional investors are buying into the dips and reflects their bullish sentiment you definitely want to always be trading in the same direction as institutional market players. Very often such decisive trends are fueled either by major economic releases, such as the US non-farm payrolls, GDP growth etc, but also interest rate decisions, trading using moving average forex, and especially when they create opportunities for carry trades.

Skip to content « Forex Trading Strategy Combining the Average True Range and the Simple Moving Average Envelope. Forex Trading Strategy — Further Talk on Using Moving Averages in Conjunction with the ATR ». Using Moving Averages in conjunction with the ATR You will learn about the following concepts Indicators used with this strategy Signals to be looking for Entry point.

Fusion Markets PayPal Accepted. Lot Size. Ava Trade. XM Group.

BEST MOVING AVERAGES - This Is What Professional Traders Use (For Forex \u0026 Stock Trading)

, time: 8:27Top 5 best Moving Average Forex trading systems

The article you are about to read explains another trend-following trading strategy, which uses a period Exponential Moving Average as the key support and resistance level to base your entry points on, in conjunction with slower EMAs for trend identification and the Average True Range for 1/28/ · In the next tutorial of the moving averages, we’ll discuss trading strategies using moving averages as well as combining two different averages and using their crossover as a signal. What Is a Moving Average in Forex Conclusion. To answer what is a moving average in Forex, you need to understand what they are and how they work 11/3/ · Moving averages are a frequently used technical indicator in forex trading, especially over 10, 50, , and day periods. The below strategies aren't limited to a particular timeframe and could

No comments:

Post a Comment