May 06, · What Is Margin in Forex Trading? Margin is the collateral (or security) that a trader has to deposit with their broker to cover some of the risk that the trader generates for the broker. It is usually a fraction of a trading position and is expressed as a percentage. It is useful to think of your margin as a deposit on all your open blogger.comted Reading Time: 8 mins Margin in trading is the deposit required to open and maintain a position. When trading on margin, you will get full market exposure by putting up just a fraction of a trade’s full value. The amount of margin required will usually be given as a blogger.comted Reading Time: 5 mins Feb 23, · Margin is simply a portion of your funds that your forex broker sets aside from your account balance to keep your trade open and to ensure that you can cover the potential loss of the trade. This portion is “used” or “locked up” for the duration of the specific blogger.comted Reading Time: 5 mins

What is Margin in Forex Trading? | Meaning and Example | IG US

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies.

You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. See our updated Privacy Policy here. Note: Low and High figures are for the trading day.

Using margin in forex trading is a new concept for many traders, meaning of margin in forex, and one that is often misunderstood. To put simply, margin is the minimum amount of money required to place a leveraged trade and can be a useful risk management tool. Closely linked to margin is the concept of margin call - which traders go to great lengths to avoid. Not knowing what margin is, can turn out to be extremely costly which is why it is essential for forex traders to have a solid grasp of margin before placing a trade.

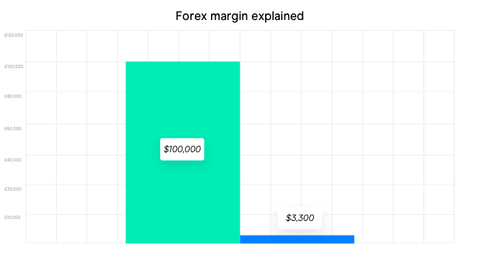

Keep reading to learn more about using margin in forex trading, how to calculate it, and how to effectively manage your risk. Forex margin is a good faith deposit that a trader puts up as collateral to initiate a trade. Essentially, it is the minimum amount that a trader needs in the trading account to open a new position. This is usually communicated as a percentage of the notional value trade size of the forex trade. Below is a visual representation of the forex margin requirement relative to the full trade size:.

Before continuing, it is important to understand the concept of leverage. Leverage and margin are closely related because the more margin that is required, the less leverage traders will be able to use. This is because the trader will have to fund more of the trade with his own money and therefore, is able to borrow less from the broker.

Leverage has the potential to produce large profits AND large losses which is why it is crucial that traders use leverage responsibly. Take note that leverage can vary between brokers and will differ across different jurisdictions — in line with regulatory requirements. Typical margin requirements and the corresponding leverage are produced below:. Forex Margin requirements are set out by brokers and are based on the level of risk they are willing to assume default riskwhilst adhering to regulatory restrictions.

More often than not, margin is seen as a fee a trader must pay. However, it is not a transaction cost, but rather a portion of the account equity that is set aside and allocated as a margin deposit. When trading with forex margin, it is important to remember that the amount of margin needed to hold open a position meaning of margin in forex ultimately be determined by the trade size. As trade size increases, traders will move to the next tier where the margin requirement in monetary terms will increase as well, meaning of margin in forex.

Margin requirements can be temporarily increased during periods of high volatility or, in the lead up to economic data releases that are likely to contribute to greater than usual volatility.

The first two tiers maintain the same margin requirement at 3. After understanding margin requirement, traders need to ensure that the trading account is sufficiently funded to avoid margin call, meaning of margin in forex. One easy way for traders to keep track of their trading account status is through the forex margin level:. The forex margin level will equal and is above the level.

If the forex margin level dips below the broker generally prohibits the opening of new trades and may place you on margin call.

It is essential that traders understand the margin close out rule specified by the broker in order to avoid the liquidation of current positions. When an account is placed on margin call, the account will need to be funded immediately to avoid the liquidation of meaning of margin in forex open positions. Brokers do this in order to bring the account equity back up to an acceptable level, meaning of margin in forex. Equity : The balance of the trading account after adding current profits and subtracting current losses from the cash balance.

Margin requirement: The amount of money deposit required to place a leveraged trade. Used margin : A portion of the account equity that is set aside to keep existing trades on the account. Free Margin: The equity in the account after subtracting margin meaning of margin in forex. Margin call : This happened when a traders account equity meaning of margin in forex below the acceptable level prescribed by the broker which triggers the immediate liquidation of open positions to bring equity back up to the acceptable level.

Forex margin level: This provides a measure of how well the trading account is funded, by dividing equity by the used margin and multiplying the answer by Leverage: Leverage in forex is a useful financial tool that allows traders to increase their market exposure beyond the initial investment by funding a small amount of the trade and borrowing the rest from the broker.

Traders should meaning of margin in forex that leverage can result in large profits AND large losses. Another way of thinking about this is that it meaning of margin in forex the amount of cash in the account that traders are able to use to fund new positions.

When trading on a margined account it is crucial for traders to understand how to calculate the amount of margin required per position if this is not provided on the deal ticket automatically. Be aware of the relationship between margin and leverage and how an increase in the margin required, lessens the amount of leverage available to traders. Monitor important news releases with the use of an economic calendar should you wish to avoid trading during such volatile periods.

It is considered prudent to have a large amount of your account equity as free margin. This assists traders when avoiding margin calls and ensures that the account is sufficiently funded in order to get into high probability trades as soon as they appear.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading, meaning of margin in forex. FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions. Live Webinar Live Webinar Events 0.

Economic Calendar Economic Calendar Events 0. Duration: min. P: R:, meaning of margin in forex. Search Clear Search results. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines.

Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets, meaning of margin in forex. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar.

Consumer Confidence JUN. P: R: Housing Starts YoY MAY. P: R: 7. GDP Growth Rate YoY Final Q1. F: Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides. Company Authors Contact. of clients are net long.

of clients are net short. Long Short. News US Yields Going Which Way? Stocks Keep Climbing; Bitcoin Line in the Sand - The Macro Setup Oil - US Crude.

Crude Oil Price Forecast: A Slow and Steady Grind Higher, meaning of margin in forex, but Red Flag Appears Wall Street. News Dow Jones Steady as Tech Stocks Rally, Hang Seng May Rebound US Yields Going Which Way? More View more. Meaning of margin in forex Article Next Article.

Explaining Balance, Equity, Margin, Free margin and margin level on MT4/MT5 mobile platform.

, time: 6:46Using Margin in Forex Trading

Mar 11, · Margin means trading with leverage, which can increase risk and potential returns. The amount of margin is usually a percentage of the size of the forex positions and will Margin is the amount of money that a trader needs to put forward in order to open a trade. When trading forex on margin, you only need to pay a percentage of the full value of the position to open a trade. Margin is one of the most important concepts to understand when it comes to leveraged forex trading, and it is not a transaction cost Margin in trading is the deposit required to open and maintain a position. When trading on margin, you will get full market exposure by putting up just a fraction of a trade’s full value. The amount of margin required will usually be given as a blogger.comted Reading Time: 5 mins

No comments:

Post a Comment