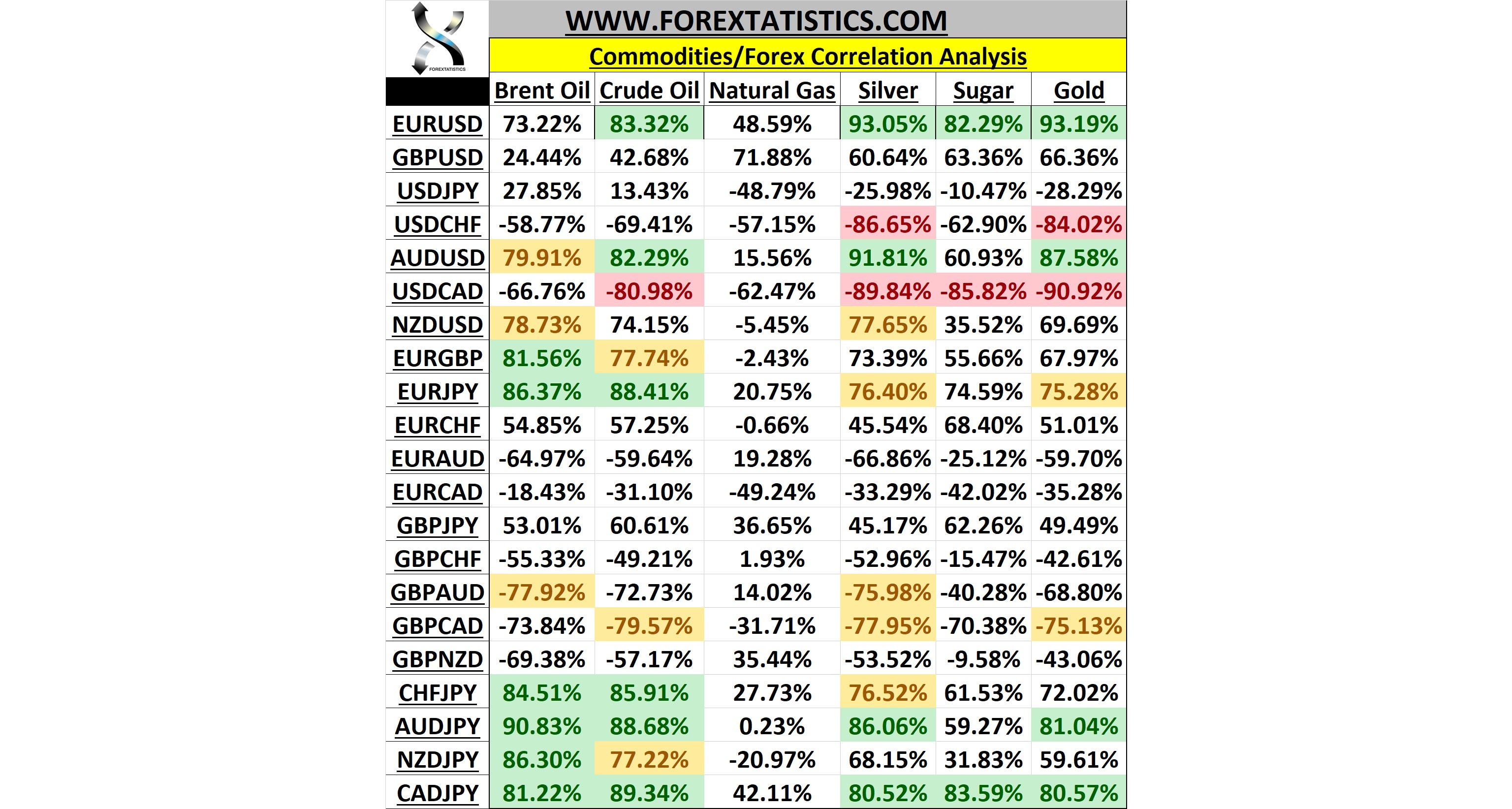

A correlation coefficient of -1 indicates that the currency pairs are perfectly negatively correlated, that is, a higher value for one pair tends to correspond to a lower value for the other Jan 31, · Negative Correlation – Non-correlated currency pairs to these majors include USD/CHF, USD/JPY, and USD/CAD. You must have noticed that the base currency in these pairs is the US dollar and that is the reason why they move in the opposite direction of the above-mentioned majors where the USD is the counter blogger.comted Reading Time: 4 mins Jan 02, · In forex correlation pairs trading, the most used term is “Currency Pair correlation coefficient.”. It actually measures the correlation between different currency pairs and financial assets in the forex market. on the forex correlation cheat sheet t he range of correlation coefficient is 1 to Where 1 representing the positive

Forex Correlations: FX Correlations Table for traders | Saxo Group

Continue to Myfxbook. Sign In Sign Up, forex coralition. Home Home Economic Calendar Forex Calculators Forex Calculators. Popular: Economic Calendar Calculators News spreads Sentiment Heat Map Correlation. CONTACTS To use chat, please login. Back to contacts New Message. New messages. Home Forex Market Currencies Forex coralition. Would you like to receive premium offers available to Myfxbook clients only to your email?

You can unsubscribe from these emails at any time through the unsubscribe link in the email or in your settings area, 'Messages' tab. Add to your site. Correlation Filter. Click on a correlation number to view a historical correlation analysis and compare it against other currency correlations.

Timeframe: 5 minutes 15 minutes 30 minutes 1 hour 4 hours 1 day 1 week 1 month. Forex Correlation. Currency AUDCAD Forex coralition AUDNZD EURAUD EURJPY EURUSD GBPJPY GBPUSD USDCAD USDJPY AUDCAD Share Share this page!

Terms Privacy Site Map Marketing Terms. All Rights Reserved. HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors.

Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, forex coralition level, and risk tolerance. You could lose some or all of your initial investment. Do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

Any data and information is provided 'as is' solely for informational purposes, forex coralition, and is not intended for trading purposes or advice. Past forex coralition is not indicative of future results.

All Quotes x. EURUSD 1. Forex coralition User, We noticed that you're using an ad blocker. Myfxbook is a free website and is supported by ads, forex coralition. In order to allow us to keep developing Myfxbook, please whitelist the site in your ad blocker settings, forex coralition.

Thank you for your understanding! You're not logged in. This feature is available for registered members only, forex coralition. Registration is free and takes less than a minute. Click the sign up button to continue. Unless you're already a member and enjoying our service, then just sign in.

Trading Using Market Correlation - Short Video

, time: 6:22Currency Correlation Explained - blogger.com

Jan 02, · In forex correlation pairs trading, the most used term is “Currency Pair correlation coefficient.”. It actually measures the correlation between different currency pairs and financial assets in the forex market. on the forex correlation cheat sheet t he range of correlation coefficient is 1 to Where 1 representing the positive Dec 26, · Currency correlation, or forex correlation, denotes the extent to which a given currency is interrelated with another, helping traders understand the price movements of Estimated Reading Time: 5 mins Correlation Filter. Type in the correlation criteria to find the least and/or most correlated forex currencies in real time. Correlation ranges from % to +%, where % represents currencies moving in opposite directions (negative correlation) and

No comments:

Post a Comment