9/9/ · What is the Cup and Handle Pattern? The Cup and Handle is a bullish pattern that signals an uptrend. The pattern establishes when the price goes in an uptrend, followed by a significant pullback that forms a rounding bottom. This signifies a Cup. Next, the subsequent pullback occurs at the resistance level that creates a small rounding blogger.comted Reading Time: 5 mins 11/8/ · The ideal profit target for the Cup and Handle trading strategy would be equal to the same distance in price as measured from the initial Cup peak to the bottom of the Cup. The Cup and Handle pattern target maximizes the potential profit and it gives us the chance to capture the entire blogger.comted Reading Time: 8 mins There are two variations of Cup and Handle chart patterns in Forex based on their potential. There is the bullish Cup with Handle and the bearish Inverted Cup with Handle. Bullish Cup and Handle Pattern. The bullish Cup and Handle pattern is the one we have been discussing so far. It starts with a bearish price move, which gradually blogger.comted Reading Time: 8 mins

Trading the Cup and Handle Chart pattern

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. See our updated Privacy Policy here. Note: Low and High figures are for the trading day. The cup and handle pattern occurs regularly within the financial markets.

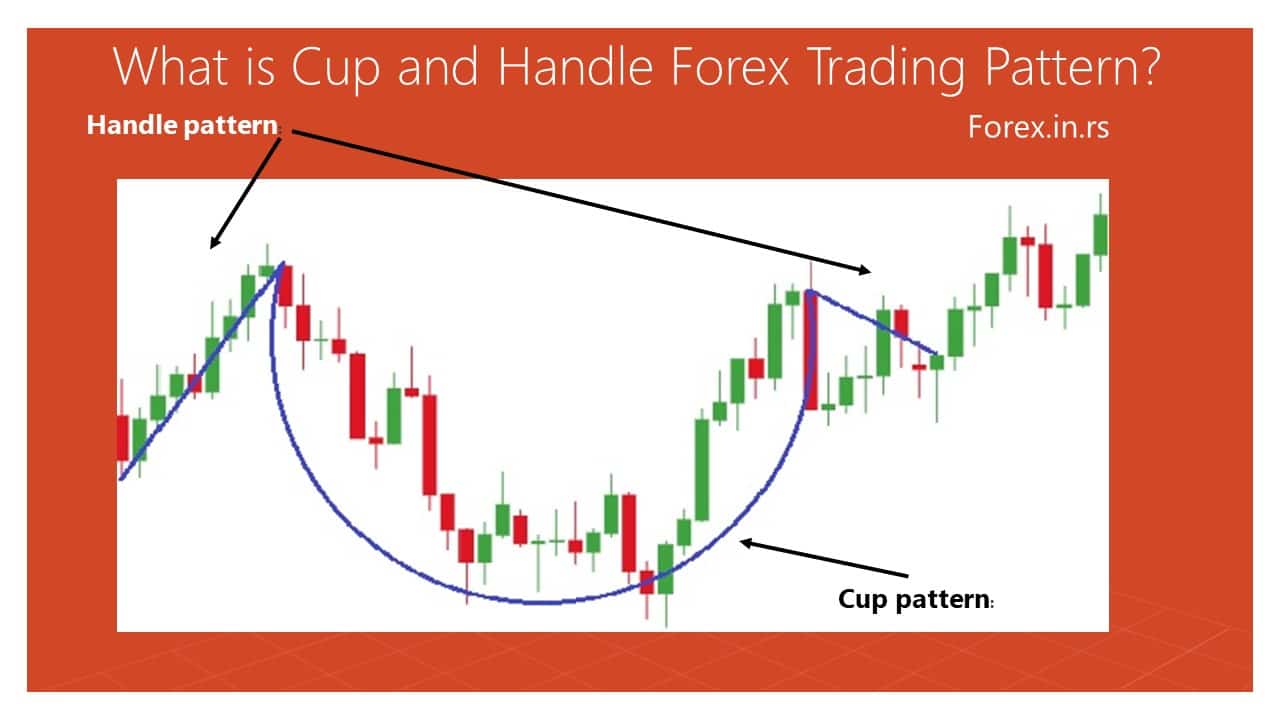

The cup and handle pattern is a continuation pattern that occurs after a preceding bullish or bearish trend. This formation provides traders with some distinctive features. The cup presents as a bowl shape cup pattern forex the handle is depicted as a downward slanting period of consolidation.

The cup and handle pattern is cup pattern forex more complex as opposed to other chart patterns which can be tricky for some traders to identify. The steps below outline a simple guide to identify the cup and handle chart pattern successfully:. Trading with the cup and handle pattern differs slightly when using it to trade forex and equities.

The volume function is often used in stock trading as a spike in volume indicates the breakout which confirms the entry signal. Forex trading does not normally use this function, and instead involves other more conventional breakout confirmation methods such as breaks above resistance. The rest of the process is the same when trading the cup and handle pattern. The image above is a monthly chart of the popular hotel and casino company Wynn Resorts Ltd.

The chart exhibits a cup and handle formation with a clear prior uptrend as marked by the trendline showing cup pattern forex highs and higher lows, cup pattern forex. A moving average may also be used instead to confirm the uptrend. The chart shows two potential entry points denoted by the green arrows. The first entry takes place on the breakout above the upper end of the price channel akin to a bullish flag with a spike in volume as verification of the move up.

The second entry uses the resistance level between the highs on either side of the cup as a key cup pattern forex level. Once this is broken, cup pattern forex, traders can look to go long. This method is less aggressive, but the patience of additional confirmation can shield against a cup pattern forex breakout with regards to the handle channel, cup pattern forex. Stop levels are often taken from the low of the handle. This can then be projected by a factor of two to arrive at a take profit limit with a ratio of risk-reward ratio.

Cup pattern forex traders prefer Fibonacci extensions as a gauge for limit levels. This choice comes down to trader preference. In this example the moving average is used to determine the former upward trend price above the day moving average, cup pattern forex. This chart is unique in that the resistance line between the highs on either side of the cup and the handle price channel coincide.

This gives the trader one entry point as a break above these two resistance points will be the same. The stop and limit points will be determined in the same manner as mentioned in the stock example. The only difference on this forex chart is the absence of the volume tool. Rising wedge and falling wedge patterns. Head and shoulders. Double top, cup pattern forex. Double bottom. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors, cup pattern forex. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits, cup pattern forex. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min. P: R:. Search Clear Search results. No entries matching your query were found.

English Français 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter. Market Overview Cup pattern forex News Forecasts Market Outlook Market News Headlines, cup pattern forex. Rates Live Chart Asset classes, cup pattern forex. Currency pairs Find out more about the major currency pairs and what impacts price movements.

Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started, cup pattern forex. Economic Calendar Central Bank Calendar Economic Calendar. Unemployment Rate MAY. P: R: 2.

Retail Sales YoY MAY. Unemployment Rate Q1. Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides. Company Authors Contact. of clients are net long. of clients are net short. Long Short. US Dollar Technical Forecast: USD in Key Zone, PMI, NFP on Deck Oil - US Crude. Wall Street. As a New Retail Trader Age Rises, Heed Tales of Past Manias Gold Price Susceptible to NFP Report amid Looming Fed Exit Strategy More View cup pattern forex. Previous Article Next Article.

Trading with the Cup and Handle Pattern Warren VenketasMarkets Writer. What is a cup and handle pattern and how does it work? How to identify a Cup and Handle Pattern The cup and handle pattern is slightly more complex as opposed to other chart patterns which can be tricky for some traders to identify.

The steps below outline a simple guide to identify the cup and handle chart pattern successfully: The cup and handle pattern is considered to be a bullish continuation pattern therefore, cup pattern forex, identifying a prior uptrend is essential. This can be done using price action techniques or technical indicators such as the moving average. The handle resembles a consolidation generally in the form of a flag or pennant pattern. This should be downward sloping but does consolidate sideways in some instances similar to a rectangle pattern, cup pattern forex.

Once this breaks that level, entry will be confirmed. Other traders use a break of the handle cup pattern forex as a long entry point. How to trade with the Cup and Handle Pattern Trading with the cup and handle pattern differs slightly when using it to trade forex and equities. Advantages and Limitations of the cup and handle pattern Advantages Limitations Easy to identify for more experienced traders Can be difficult to identify for novice traders The cup and handle can be used for both stock and forex markets Often requires further support from other technical indicators Defines clear stop, entry and limit levels The cup and handle can take extensive periods of time to play out Further reading on candlestick patterns Further your knowledge on other candlestick patterns with our guides to: 1, cup pattern forex.

Rising wedge and falling wedge patterns 2. Head and shoulders 3. Double top 4. Double bottom Test your knowledge of forex patterns with our interactive 'Forex Trading Patterns' quiz. New to forex?

Trading the Cup and Handle - Stock Chart Pattern

, time: 3:46Trading the Cup and Handle Chart Pattern for Maximum Profit

Cup and handle patterns are also traded in the forex market, especially by day traders. When intraday trading, cup and handles tend to perform better during active times of a specific currency pair. When the forex markets are not open, the pair tends to be quieter, which means less movement, and it also means that intraday cup and handle patterns will not form as strongly 8/29/ · The cup and handle pattern is a continuation pattern that occurs after a preceding bullish or bearish trend. This formation provides traders with some distinctive features. The ‘cup and handle Estimated Reading Time: 4 mins 11/8/ · The ideal profit target for the Cup and Handle trading strategy would be equal to the same distance in price as measured from the initial Cup peak to the bottom of the Cup. The Cup and Handle pattern target maximizes the potential profit and it gives us the chance to capture the entire blogger.comted Reading Time: 8 mins

No comments:

Post a Comment