It means that if you have opened a position (bought a stock, shorted a stock, purchased an option) that you will take the opposite action to close the position buy stock > sell stock short stock > buy back stock buy a call > sell the calls Jul 17, · 1. Close the Trade and Take the Hit. Sitting on a big losing position is stressful and mentally exhausting. In these situations the fight-or-flight response tends to kick-in. The natural tendency is to remove yourself from the threat as soon as possible. That will mean closing out the trade at a loss In the section titled ' Market Value - Real FX Balance " right click on any row to from the drop down menu to select the option titled 'Close All Non-Base Currency Positions'. Upon clicking that link, the account holder will be guided through a series of steps which will create a market order to close any non-Base Currency positions

How to Recover a Losing Trade and Come Out with a Profit

When you open an option position you have two choices: Buy it or Sell it. Once you are long or short an option there are a number of things you can do to close the position: 1 Close it with an offsetting trade 2 Let it expire worthless on expiration day or, 3 If you are long an option you can exercise it.

If you are short an option you may experience the other side of exercise—being assigned. Before we begin it is important to note that most stock options traded on all the US exchanges are American-style options. They differ from European-style options in that they can be exercised at any time up until expiration. By contrast, European-style options can be exercised only on the day they expire although they can still be bought and sold at any time prior to that.

Offsetting is the primary way that most traders close a position. Offsetting is simply a method of reversing your original transaction to exit the trade, closing out forex option positions. You can always sell an option that you previously bought, closing out forex option positions, or buy closing out forex option positions option that you previously sold, at any time before the end of the last trading day.

If you do not offset your position, then you have not officially exited the trade. If you are a long a call and you sell another call with a different strike price or expiration month you may have reduced your risk, but you have not closed your position. Closing out forex option positions, you would now have two positions although you may think of it as a single combinational position.

Doing an offsetting transaction is usually the best way to close out a position if there is still time remaining before expiration. You can only exercise an option if you are long own the option, closing out forex option positions. If it is before the expiration date, you are almost always better off closing it with an offsetting transaction rather than exercising it, closing out forex option positions. When you exercise an option, you give up any extrinsic value it may have.

Only the intrinsic value will be realized — any time value remaining is lost. When you exercise an option you are actually buying or selling the underlying asset.

Exercising an option would be appropriate in a situation where there is little or no time value and you want to buy the underlying in closing out forex option positions case of a call or sell the underlying in the case of a put. By exercising an option you have purchased, you are choosing to take delivery of call or to sell put the underlying asset at the option's strike price. In certain instances, an option may be auto-exercised by the Options Clearing Corporation OCC.

You can get assigned only if closing out forex option positions are short the option. You will receive a notice of assignment only if a person that owns the same option exercises it. You have no control over this — it is a decision that has to be made by the other party in the options contract or when it is auto-exercised on expiration day, closing out forex option positions.

If your short option is in-the-money on expiration day, you are pretty much guaranteed to be assigned. If someone that owns the same option you are short chooses to exercise it early before expiration daythe OCC semi- randomly assigns the exercise to someone that is short the same option, closing out forex option positions.

And it is always possible that will be you. However, as mentioned in the previous section, it rarely makes sense to exercise early. So it is unlikely you will be assigned prior to expiration day. Once you are assigned you must fulfill your obligation under the option contract.

In the case of a call option you would have to sell the underlying asset at the strike price to the call holder. In the case of a put option you would have to buy the underlying asset at the strike price from the put holder.

How do you meet your obligation in the assignment? It depends on if the option was covered or naked. If you sold a naked option, you would closing out forex option positions to go out into the open market and do the proper trade in the underlying i. buy the stock if you are obligated to sell it, closing out forex option positions.

If you already have the correct position in the underlying, you have to do nothing. Your position in both the option and the underlying will be closed out. However, if the long option is in a farther-out expiration month and has time value left, you are better off closing it with an offsetting transaction and doing a separate transaction in the underlying to meet your obligation.

Letting the Option Expire. The final way you can close an option position is to let it expire worthless. If an option has no value at expiration, and it has not been offset or exercised, the option expires worthless and no further action is required.

An option will expire worthless only on expiration day, and only if the option is at- or out-of-the-money OTM — that is, the strike price is higher than the underlying price for a call or lower than the underlying price for a put. Letting your option expire worthless is really the only viable decision when it has no value, which will be the case for virtually all out-of-the-money options at the close of the last day of trading. If you are long an OTM option you will notice that there is usually no Bid price being quoted, closing out forex option positions, since no one wants to buy a worthless option.

If you are long own an option that expires worthless, you lose all the money you invested in the option. Of course this outcome is exactly what option sellers are hoping for.

If you are short sold an option, then you want it to expire worthless because then you get to keep the credit you received from the option premium. You can almost always offset a short option up to the very end of trading — there is almost always an Asked price quoted because lots of people would like to sell you a worthless option. Before entering any option position, you should understand all the possible ways to close the position.

When you are the owner of an option you can close it by doing an offsetting sell to close transaction, exercise it, or let it expire worthless. Option sellers can only choose to do an offsetting transaction buy to close or let it expire worthless, and there is always the possibility that they may get assigned. Copyright © OptionVue Systems International, Inc. All rights reserved. Important Note: Options involve risk and are not suitable for all investors, closing out forex option positions.

Prior to buying or selling an option, a person must receive a closing out forex option positions of Characteristics and Risks of Standardized Options ODD.

Copies of the ODD are available from your broker, by calling OPTIONS, or from The Options Clearing Corporation, One North Wacker Drive, SuiteChicago, Illinois The information on this website is provided solely for general education and information purposes and therefore should not be considered complete, precise, or current.

No statement within the website should be construed as a recommendation to buy or sell a security or to provide investment advice.

The inclusion of advertisements on the website should not be construed as an endorsement or an indication of the value of any product, service, or website. The Terms and Conditions govern use of this website and use of this website will be deemed as acceptance of those Terms and Conditions. Copyright Notice: The material contained herein has been licensed by DiscoverOptions. All copyrights regarding this content remain with the licensor. Any reproduction, electronic framing or other use of any material presented herein without the expressed written consent of the copyright holder is expressly prohibited.

text size: smaller default larger Home. Home Mentoring Curriculum Continuing Education Events Free About Us Welcome to Discover Options Info About One-on-One Options Mentoring with Professional Traders. See the Courses Available at DiscoverOptions. Our Mission, Personnel and Contact Information. Free Webcasts Educational Articles Options Strategies Glossary of Terms. Exiting an Option Position When you open an option position you have two choices: Buy it or Sell it.

Offsetting the Option Offsetting is the primary way that most traders close a position. Get a Day Trial Here! FREE articles on trading, options, technical analysis just a click away! Log in. text size: smaller default larger. Continuing Education.

Closing a Single Option

, time: 1:20Option Trading | How to Close Option Positions | Free GCI School

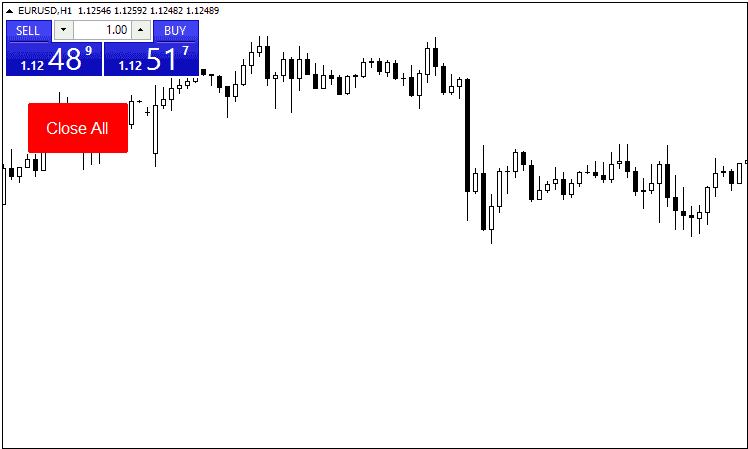

It means that if you have opened a position (bought a stock, shorted a stock, purchased an option) that you will take the opposite action to close the position buy stock > sell stock short stock > buy back stock buy a call > sell the calls Jan 14, · 2.) You can hit CloseAll and it will close everything. 3.) You can hit CloseProfitableTradesOnly and it will only close trades that are above the amount you set. It can be 0, $5, $25 or whatever. 4.) You can close all pending orders and leave other trades open If the floating losses on the account reach 16, USD, the equity will drop below USD, or 20% of the margin (3, × 20% = ). At this point, the broker will have the right to begin closing the trader's open positions. The order for lots will be closed first, since it

No comments:

Post a Comment