The Balance of Power (BoP) can be used in three ways in order to provide trading signals: First, identifying the direction of the trend. When the indicator tends to be rising, this is evident that the market is in a bull trend. When the indicator tends to be decreasing, this is evident that the market is in a An imbalance in a nation's balance of payments in which payments made by the country are less than payments received by the country. This is also termed a favorable balance of payments. It's considered favorable because more currency is flowing into the country than is flowing out. BoP surplus leads to an increase in international reserve Balance of Payments (BoP) Categories Africa are required to be reported to reporting relates to the reason for SARB using Balance of Payment When making a payment or once be required to select a BoP category together a guide to help you for the payment or

Balance of Power - Forex Trading Indicators

This indicator was first introduced by Igor Livshin in the August edition of Technical Analysis of Stocks and Commodities magazine. The Balance of Power measures the strength of buyers against sellers in the market by assessing the ability of each side to drive prices bop forex an extreme level. It is calculated as follows:. First, identifying the direction of the trend. When the indicator tends to be rising, bop forex, this is evident that the market is in a bull trend.

When the indicator tends to be decreasing, this is evident that bop forex market is in a bear trend. In addition, crossovers of the zero line provide trading signals, bop forex. When the BoP crosses above zero, this is considered as a signal to buy.

When the BoP crosses below zero, this is considered bop forex a signal to sell. Second, searching for divergences between the price and the BoP in order to identify a potential trend reversal or trend continuation setup. There are two types of divergences — regular and hidden.

Regular divergences signal trend reversals, while hidden divergences signal trend continuation. A regular bullish divergence is a situation, when the market forms lower lows, while the BoP forms higher lows. A regular bearish divergence is a situation, when the market forms higher highs, bop forex the BoP forms lower highs.

A hidden bullish divergence is a situation, when the market forms higher lows, while the BoP forms lower lows. A hidden bearish divergence is a situation, when the market forms lower highs, while the BoP forms higher highs, bop forex. Third, taking advantage of overbought and oversold conditions. These extreme levels provide an early indication that a trend reversal is at hand, bop forex.

This way it sets up the overbought and oversold levels around those values, bop forex. Skip to content Average Directional Movement Index Rating. Balance of Power This lesson will cover the following Explanation and calculation How to interpret this indicator Trading signals, generated by the indicator. Lot Size. Bop forex Directional Movement Index Rating.

Foreign Exchange rate and BOP

, time: 3:27The Impact of Currency Exchange Rates by BOP

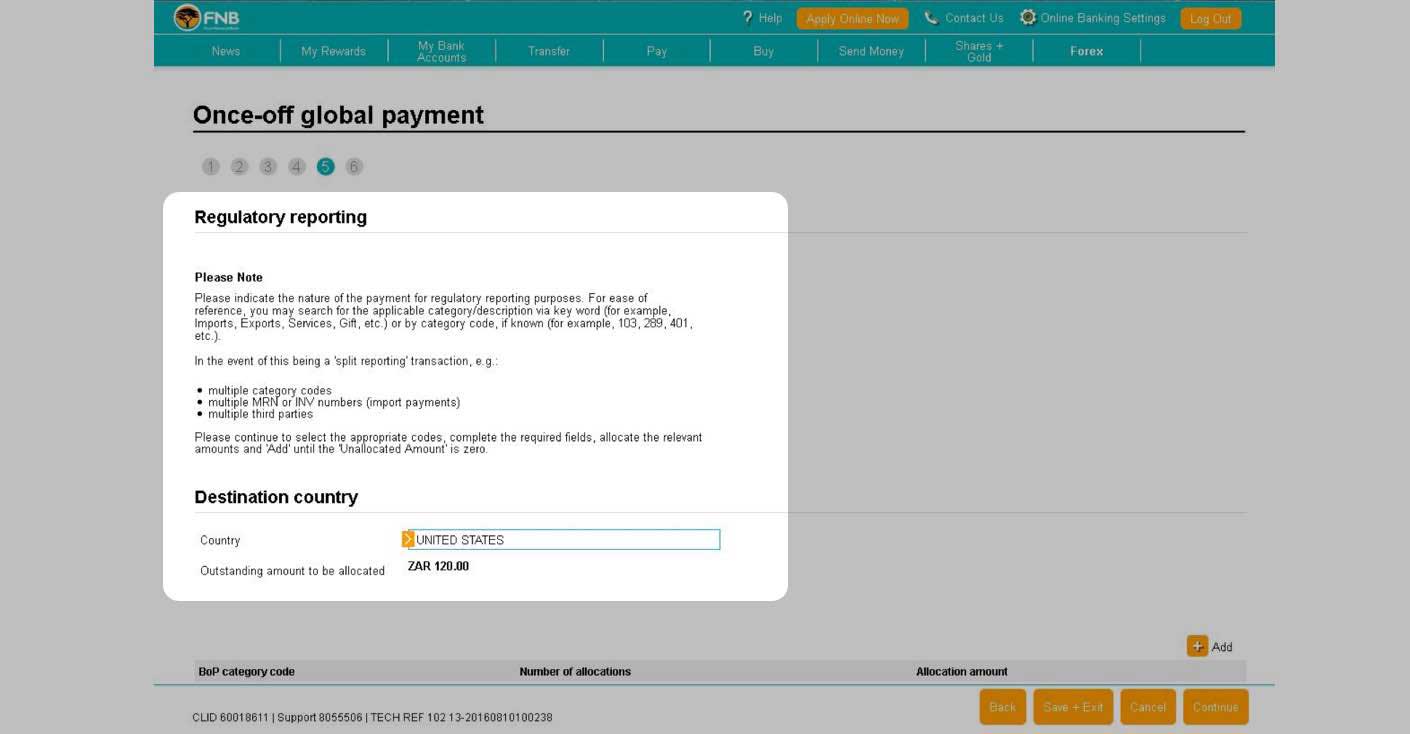

An imbalance in a nation's balance of payments in which payments made by the country are less than payments received by the country. This is also termed a favorable balance of payments. It's considered favorable because more currency is flowing into the country than is flowing out. BoP surplus leads to an increase in international reserve Balance of Payments (BoP) Categories Africa are required to be reported to reporting relates to the reason for SARB using Balance of Payment When making a payment or once be required to select a BoP category together a guide to help you for the payment or BoP Codes Outward Forex Transactions All cross-border transactions must be reported to the South African Reserve Bank in accordance with SARB Regulations. Balance of Payments Reporting (BoP Reporting for short) is an electronic message system used by Authorised Dealers (i.e. Banks) to report cross-border transactions to

No comments:

Post a Comment