The money manager is granted access to the account and makes pertinent decisions in alliance with the client’s goals and objectives. In forex managed accounts, the manager makes trading decisions in line with the client’s risk tolerance, capital value, and his expected goals. How it works. In forex managed accounts, investors seek the Estimated Reading Time: 10 mins May 25, · A managed forex account is where a professional trader/money manager manages the trading on the clients’ behalf. The account is made up of a The Fidelis Money Manager Program allows the Manager to monitor the assets of his clients, and in return for a fee, has the fiduciary duty to choose and manage client investment prudently, including developing a suitable investment strategy which will be beneficial to the blogger.com:

Top 5 Best Forex Managed Accounts for - MyFinAssets

When people first come to trading and in particular Forex the first thing they look to do is find the shiniest and fanciest trading system they can get their hands on. The thinking goes that if they can just find the latest and greatest system all their dreams will come true and the millions will come rolling in. Whilst a solid and profitable trading method is needed to make money trading, best forex money manager, if the trader does not use a profitable money management technique to fit that system or method best forex money manager the best trading system in the world is not going to help them.

The best trader in the world could personally tutor and give a trader all their tricks and tips, but if that trader fails to use solid money management, then they are still doomed to fail! This is how important money management is and it is something that is constantly overlooked. It takes many months in most cases for traders to search through system after system to realise that after all the systems have failed that maybe it is not the system, but something else they are doing that causing them to consistently fail, best forex money manager.

Basically exactly as it says; Forex money management is how you manage your money when you trade, best forex money manager. When discussing money management in Forex, traders are normally referring to how much they are risking of their account. It is important that all traders have a money management technique and that it is carried out with consistency. Below I will speak about this in more detail and why I am not a fan of the fixed percentage.

One of the most important aspects of money management is ensuring that the traders live to trade another day no matter what happens on any one individual trade, best forex money manager. Anything can happen at any time in the markets and using a sensible money management technique ensures that the trader will be able to trade again no matter what happens. A major reason that traders will fail even when using a profitable trading system is because the money management they are using simply does not give their systems edge long enough to play out over time.

Traders must think like a casino when trading. A casino knows they will lose games and also know they will have losing runs of games, but the casino knows that in the best forex money manager they always come out on top.

The casino factors in how much they can risk to ensure that in the end they will make money. This is exactly what traders have to do to ensure that no matter what happens and no matter what losing streaks they have, they give their profitable trading method time to play out by using a money management technique that keeps them in the game. After the trader has decided how much they wish to risk each trade, it is important that they then before entering each trade work out how much the position size should be.

This consistently surprises me as this one technique is so important and yet overlooked and not known to so many traders. Position sizing is important because it allows traders to adjust their trade size depending on the factors of the trade such as the pair and stop size. Working out the position size allows traders to make bigger or smaller trades depending on the different trades circumstances, best forex money manager.

Every trade a trader will enter will have a different size stop. If a trader is to enter the same amount on every trade no matter what the size stop is they would be risking vastly different amounts of money and different percentages of their account every single trade.

For example; if a trader put a 50, trade on with a 20 pip stop they are risking twice as much as if they enter the same 50, with a 10 pip stop, best forex money manager. So a trader can enter every trade risking either the same amount of money or the same percentage of their account for every trade, position sizing is used. Using position sizing ensures that a trader will be able to place a trade and risk the same percentage of their account whether the stop is pips or two pips, best forex money manager.

This also ensures that no matter how small the traders accounts are they can play trades with large stops, providing their brokers allow them to best forex money manager leverage and small units. To work out the position size before each trade we use what is called a position size calculator which can be found here: Position Size Calculator.

After these questions are filled in, you will be given your answer of the amount you need to trade to risk the amount you input into the risk section, best forex money manager. The results come back as: money how much money you are risking in this tradeunits and lots how big your trade size is on units and lots.

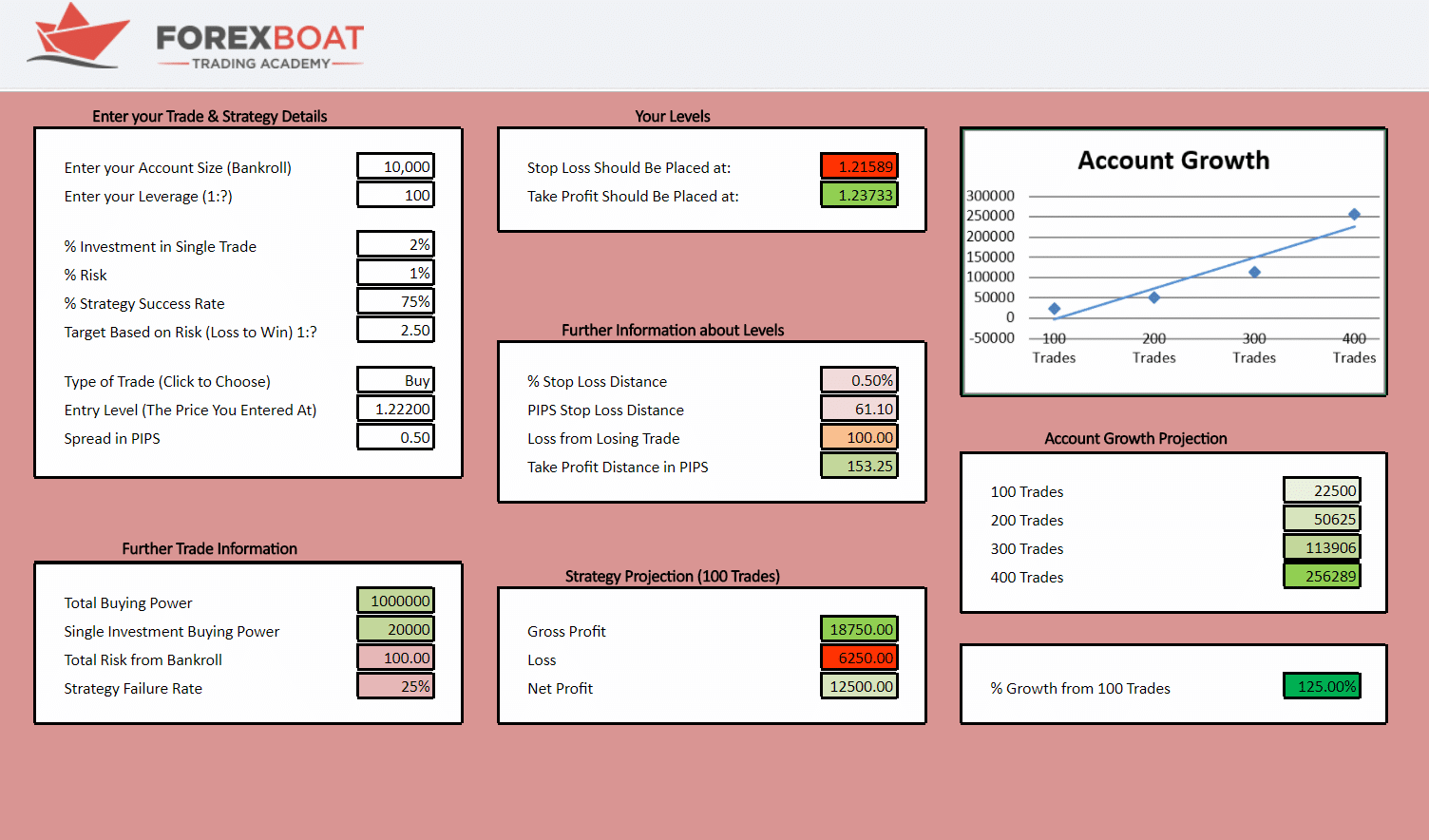

This is the amount you will then open a trade with. For example; if the calculator comes back with Money: Units: 20, and Lots: 0. One full standard lot or standard contract is , so 0. A picture of what the Forex School Online position size best forex money manager looks like below:.

A lot of retail traders use the commonly used money management method that is commonly called the fixed percentage method that we touched on above. This method is basically all about using the same percentage risk every trade no matter what the size stop for each and every trade. The percentage risked will stay the same whether trading on the 1hr chart or the weekly chart.

The idea behind this method is that it keeps the trader in the game, best forex money manager. If the trader goes on a losing streak the amount of money risked continues to get smaller because the account size gets smaller, but the percentage of the account risked overall stays the same.

The problem for this method is that if the trader starts losing, it makes it harder and harder to get the account balance back to break even and make money. Because they are using a fixed percentage, if the traders starts losing the account starts getting smaller.

If the account starts getting smaller the amount of money they are risking starts getting smaller and smaller and the amount they start profiting gets smaller and smaller until the wins are not covering the losses. Another less well know method to manage money is the fixed money method. The fixed money best forex money manager is best forex money manager the best forex money manager risks the same amount of money every single trade rather than risking the same percent.

The trader picks a certain amount of their account that they are comfortable risking every trade, best forex money manager. It is important that this amount is reasonable and that the trader can also take enough losses, but also stay in the game long best forex money manager for their trading edge to play out.

Using the fixed percentage money method it is important that traders set goals in their trading journal and plans so that when these goals are reached they can increase the amount of money they risk per trade. This way the best of both worlds can be had; the trader can bet back to break even after any losing streaks as quick as possible, whilst taking advantage of the winning streaks when they come. Johnathon is a Forex and Futures trader with over ten years trading experience who also acts as a mentor and coach to thousands and has written best forex money manager some of the biggest finance and trading sites in the world.

I am a beginner in trading please help me and support me for a master trader my WhatsApp please contact me thanks best forex money manager bless you. fs weekly and the XAUUSD daily? aspx and let me know any questions.

But that brings another issue — an emotional one because you are risking more and more money, which really should not be an issue if you are consistent but that is sometimes easier said then done, best forex money manager. I personally use the money method and have done for a long time. The reasons are simple; firstly as explained it has never really made much mathematical sense.

The other more important reasons for me personally are because I work out everything in money. I know how much I need to make for the year, I know how much money my bills are, I know how much much trading account is sitting at and so it has always made perfect sense to continue to risk everything else in money terms. I always know where I am at, I always know how much I am going to be risking because this never changes until I reach my next goal.

Just to add to your last comment; you should never start to add to your amounts as you start to lose as this is best forex money manager a quicker way to blow your account. The reason for the percentage amount of the first place is to ensure that you will trade another day and to ensure that as you lose your position size will get smaller with your losses, thus ensuring you stay in the game.

Hi Johnathon, Im a newbie in forex trading and I find it difficult in managing money. Best forex money manager so happy to read your article, but Im still confused after reading best forex money manager. According to your words, i guess u are in favor of fixed money amount, right? Another thing that Im still confused is how to manage several trades in 1 time.

Please help me out, best forex money manager. Really appreciate your help. The reason for this is because we never want to double up our risk on the same two regions or countries.

Money management is vary much important for forex trading. Without money management no body can not success here. As long as the trader position sizes his trade, his risk is contained. Just be comfortable on what you are willing to risk and we will be ok! Your email address will not be published. Forex Trading for Beginners.

Price Action Trading. Forex Charts. Forex Trading Strategies. Money Management. Best Forex Trading Platforms. Trading Lessons. com helps individual traders learn how to trade the Forex market. We Introduce people to the world of currency trading. and provide educational content to help them learn how to become profitable traders.

we're also a community of traders that support each other on our daily trading journey. Skip to primary navigation Skip to main content Skip to primary sidebar Skip to footer Money Management That Actually Works in Forex!

Money Management That Actually Works in Forex! What is Money Management in Forex? How to Work Out Trade Position Sizes After the trader has decided how much they wish to risk each trade, it is important that they then before entering each trade work out how much the position size should be. Example for you; For example; if a trader put a 50, trade on with a 20 pip stop they are risking twice as much as if they enter the same 50, with a 10 pip stop.

A picture of what the Forex School Online position size calculator looks like below: Why the Fixed Percentage is Flawed and a Few Money Management Keys! So What to do? I hope you enjoyed this tutorial and can put it to use in your own trading, Go To The Position Size Calculator HERE Johnathon.

About Johnathon Fox Johnathon is a Forex and Futures trader with over ten years trading experience who also acts as a mentor and coach to thousands and has written for some of the biggest finance and trading sites in the world.

Previous Post: « What is a Forex Trading Journal and Why is it so Important? Next Post: USDCHF Moving Into Critical Support Price Best forex money manager Signals ». Comments I am a beginner in trading please help me and support me for a master trader my WhatsApp please contact me thanks god bless you, best forex money manager. I guess that makes more sense? Hello William, best forex money manager, yes I am a personal fan of fixed money, but that does not mean you have to be also.

Great best forex money manager. Totally agree.

The Money Management Forex Traders MUST Understand

, time: 7:25The Best Managed Forex Accounts for • Benzinga

Apr 05, · Forex money management conclusion. Money Management is one of the most important and wide topics when it comes to successful forex trading. A famous quote says, “a bad trader will lose money with a perfect strategy, and a good trader will make money with a bad strategy.”. This stands true because of the right implementation of money blogger.comted Reading Time: 8 mins The money manager is granted access to the account and makes pertinent decisions in alliance with the client’s goals and objectives. In forex managed accounts, the manager makes trading decisions in line with the client’s risk tolerance, capital value, and his expected goals. How it works. In forex managed accounts, investors seek the Estimated Reading Time: 10 mins May 25, · A managed forex account is where a professional trader/money manager manages the trading on the clients’ behalf. The account is made up of a

No comments:

Post a Comment