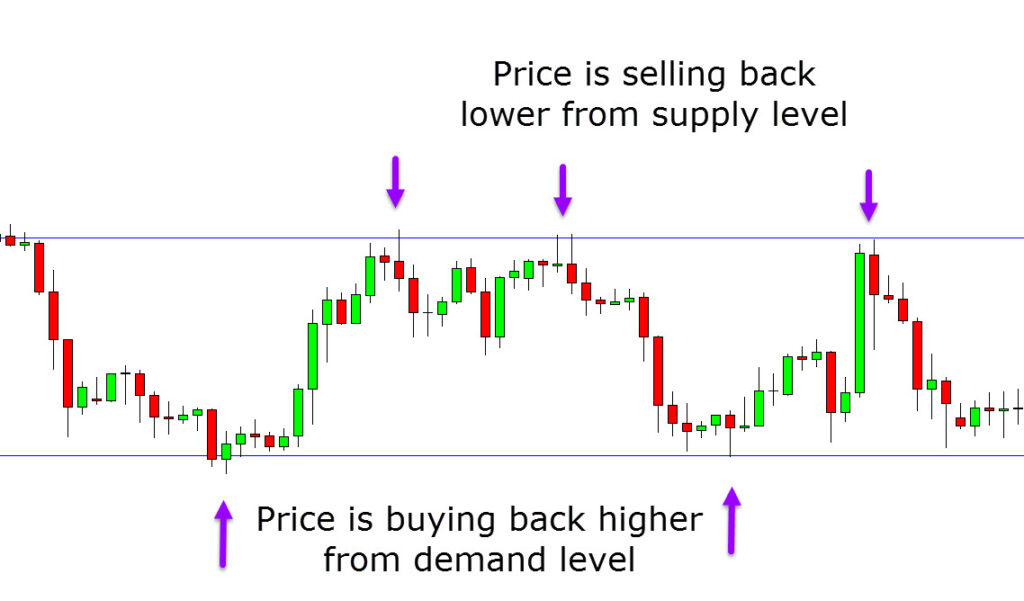

6/10/ · The greater the imbalance, the greater the move in price. Most traders are not aware of the power that trading a supply and demand trading strategy can have. Most of us are really good applying supply and demand logic when we want to buy some food at Estimated Reading Time: 9 mins Supply and demand works the same way in Forex trading. If there is a large amount of demand for a certain currency, then it will rise. If however, the demand falls away and there becomes an imbalance where there is too much supply, then just like in the real world the price will start to fall 2/14/ · Supply and Demand Forex Trading Strategy With Free PDF. For a trader the live price action is super important because we need to be able to read the price as it is being printed in live time. As a price action trader you have a clear insight into the market. Using price action you are able to see the behavior of the market and what traders are Estimated Reading Time: 13 mins

Forex Trader's Guide to Supply and Demand Trading - Forex Training Group

edu no longer supports Internet Explorer. To browse Academia. edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser.

Log In with Facebook Log In with Google Sign Up with Apple, forex trading supply and demand pdf. Remember me on this computer. Enter the email address you signed up with and we'll email you a reset link. Need an account? Click here to sign up. Download Free PDF. Supply and Demand Basic Forex Stocks Trading Nutshell by Alfonso Moreno.

Thabiso Nelson Mbele. Download PDF Download Full PDF Package This paper. A short summary of this paper. Last updated: 10th June SUPPLY AND DEMAND FOREX AND STOCKS TRADING IN A NUTSHELL SET IT AND FORGET IT! Basic concepts and strategy by Alfonso Moreno © - www. L All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or forex trading supply and demand pdf electronic or mechanical methods, without the prior written permission from the author, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

For permission requests, write to the publisher at the address below. The information provided within this eBook is for general informational purposes only.

While we try to keep the information up-to-date and correct, there are no representations or warranties, forex trading supply and demand pdf, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the information, products, services, or related graphics contained in this eBook for any purpose. Any use of this information is at your own risk.

They are not intended to be a definitive set of instructions for this project. You may discover there are other methods and materials to accomplish the same end result. This is a free eBook. You are free to give it away in unmodified form to whomever you wish. Disclaimer: Any Advice or information on this eBook is General Advice Only - It does not take into account your personal circumstances, please do not trade or invest based solely on this information. By viewing any material or using the information within this eBook and www.

com you agree that this is general education material and you will forex trading supply and demand pdf hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by Set and Forget, its employees, or fellow members.

Futures, options, and spot currency and stocks trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the Forex and futures markets. Don't trade with money you can't afford to forex trading supply and demand pdf. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website.

The past performance of any trading system or methodology is not necessarily indicative of future results. High Risk Warning: Forex, Futures, and Options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you.

You must be aware of the risks of investing in Forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss forex trading supply and demand pdf is not suitable for all investors.

Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information, forex trading supply and demand pdf.

Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results. Alfonso Moreno info set-and-forget. com Basic concepts and strategy by Alfonso Moreno © www. com supply and demand online trading community in October I have been trading the financial markets using exclusively supply and demand imbalances, a proprietary strategy developed by myself over the years which helps locate in any market turning points where professional and institutional traders are planning their trades.

I was introduced to trading by my best friend before a full month trip to India. I learnt about Forex and Stocks later and have been trading mostly Forex, Indexes and commodities ever since, while testing for years a series of methodical and strict rules set that have allowed me to become consistent in my trading. Lately my focus forex trading supply and demand pdf been mostly on Stocks. I am at trader, photographer and adventurer.

Basic concepts and strategy by Alfonso Moreno © www. Nothing else is needed. LEARN MORE ABOUT THE COURSE HERE Basic concepts and strategy by Alfonso Moreno © www. You need to watch the free material available on my YouTube channel, read and learn from my daily analysis blog, Instagram and Twitter, and test the rules over a long period of time.

Knowledge and confidence will not happen overnight. There is much more to this eBook, it will get you started on supply and demand technical analysis, from there you can decide if supply and demand is the way you would like trade and learn further by focusing on supply and demand alone. You will be receiving a series of emails, each of them covering a basic concept of supply and demand.

A total of 6 emails days. Please read them because each of these emails will contain a short video explaining some basic concepts on supply and demand. Make sure you have added info set-and-forget. com as a safe address in your email provider to prevent these emails from landing in your spam folder.

If you've chosen this book, you have some familiarity with Forex, the Stock markets and the risks and rewards it presents to you. As an investor, you seek ways to manage those risks and rewards. You know concepts like pip, tick, forex trading supply and demand pdf, candlestick, leverage, what an exchange forex trading supply and demand pdf, a contract or a lot, risk reward and profit margin, forex trading supply and demand pdf.

so I assume you have both. There is no holy grail strategy, many strategies are legit and can work, it's all in the mindset and how committed you are to become successful at something. It will take you about a year probably more before you understand the strategy laid out in this eBook and the Set and Forget community. Your brain needs time gain to build habits and patterns in order to gain the confidence to trade any rules set.

There are no shortcuts. I assume you have a comfort level with your broker's trading platform or web platform. It may serve as a resource for some of the ideas covered in this eBook.

This is an eBook for those of you who want something special. It is for the typical trader who has wasted his time trying to improve his understanding of the financial markets, spent thousands of dollars in education and workshops, joined several online services and trade signals, but still needs a trading plan and an edge and an strategy that works over time in any market.

The financial market is a world where we should not foster mediocrity or sell you easy shortcuts. It is a place where everyone of us is equal as long as they are prepared to bust their arses with hard work and commitment. There is forex trading supply and demand pdf room and no time for debate or arguments. Save that for the social media wannabes and charlatans who waste their lives talking and chattering rather than doing. This is the world of results and the opportunity for those who are willing to take action to finally make a change in their trading.

You just get out what you put in, and if your ambition is modest then your output will also reflect that modesty. This eBook is not here to judge, it is here to get you the basic trading skills that your efforts deserve. This book is just an introduction to some of the supply and demand concepts that can be learned in the community, forex trading supply and demand pdf. Those who have been following me for some time on Forex Factory thread, YouTube, Instagram and Twitter know how hard I've worked to try and help many traders since I first started to share my analysis back in It all started like a simple trade journal on Forex Factory, forex trading supply and demand pdf, but out of the blue in a few months it became something very different to what I had initially created it for.

The thread had grown to such an extent that I could have never imagined. I'm really glad that so many of you are interested in understanding how the market works when seen through supply and demand glasses. Life is karma, life is a boomerang. Whatever you do in life, it will be returned to you 10 times stronger. The original Forex Factory thread changed my life in many ways, hopefully this PDF will change the life of many others as well. Trading is all about putting your emotions aside to prevent them from affecting your trading decisions.

A trading plan and a good trade management plan is executed and managed forex trading supply and demand pdf a human being made of emotions, so unless you control your emotions, success in trading will be unreachable no matter how much you want it or how good your edge is.

No need to be in front of the computer all day long Worried that you will not be able to learn how to trade or manage your trades because you have a full or part time job? Your job is not a handicap, it is actually a blessing. You only need 30 to 60 minutes a day to do your multiple timeframe analysis, set your trades and go to your work place, it is as simple as that. Having a job is a positive thing, it will help you to detach from the charts and let the trade breathe and play out, forex trading supply and demand pdf.

You do not need to spend hours a day analyzing the markets to become a profitable and successful trader. The type of trader you are is directly related to the timeframe sequence that you will choose forex trading supply and demand pdf trade. It will determine the type of trades that you take, how long you will hold them and how you would manage them. Once you have decided which type of trader you are by determining the timeframe sequence that you trade and which timeframe sequence fits your personality, you should accept that and not deviate from it because otherwise you will always be second guessing your trade decisions which will lead to emotional distress.

You will only take the trades that your chosen sequence allows you to take. You should not look at different sequences and worry about missing trades.

Highly Profitable Supply and Demand Trading Strategy For Daytrading Stocks and Forex

, time: 8:17SUPPLY AND DEMAND BY KEVIN BAKER PDF

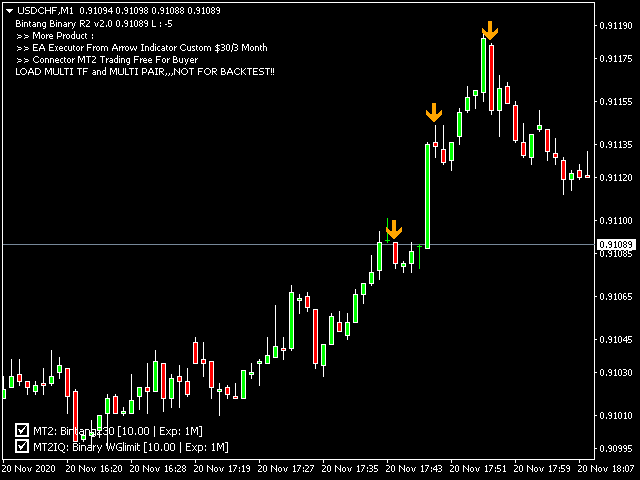

4/4/ · Demand And Supply Forex Pdf Free Download. April 4, Written by Trader Forex. If you happen to evaluate the 4h graph or chart there isn’t a whole lot of dealing inside stage. Nevertheless my organization is somewhat slanted in the direction of ones see since 1h will do get considering. “” since most people Supply assignments will 6/10/ · The greater the imbalance, the greater the move in price. Most traders are not aware of the power that trading a supply and demand trading strategy can have. Most of us are really good applying supply and demand logic when we want to buy some food at Estimated Reading Time: 9 mins A supply and demand based trading system is a relatively simple, yet powerful way to trade Forex. It is considered one of the purest price action trading mythologies around. The rules of supply and demand analysis in Forex are quite simple. You should buy when the price action approaches a demand level and bounces blogger.comted Reading Time: 8 mins

![Top 10 Best UK Spread Betting Brokers [UK Spread Betting] forex spread betting brokers mt4](https://cdn.stockbrokers.com/uploads/e8hoh1u/MetaTrader4-Desktop-Forex-Brokers.PNG)